What is Net Worth?

Some people think, what does net worth mean? – questioning whether it’s reserved for the rich and famous, for your high-revenue generating businesses. It’s for you and everyone around you with an accumulation of wealth.

If you want to know the net worth meaning, there are various definitions if you search for ‘what is net worth’. One is that net worth is the value of the assets a person or business has, minus liabilities they owe out.

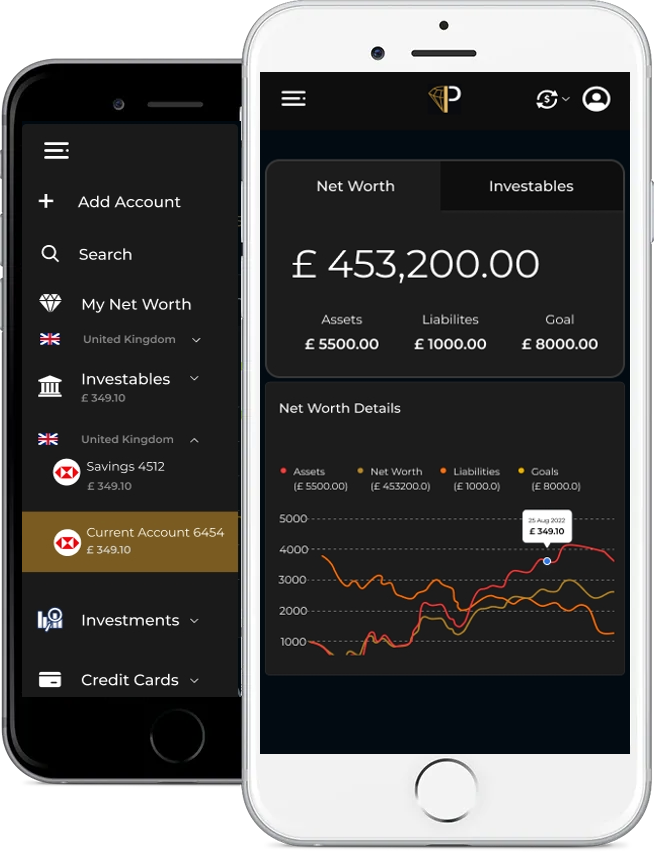

Throw your assets and liabilities into a net worth calculator, and you’ll have a clear understanding of your overall financial picture. Some people – especially those with more net worth meaning more liabilities and assets – use a net worth tracker to monitor their finances closely. And, by using software like the Prillionaires Wealth Management Software that has a faultlessly accurate net worth calculator built-in, it’s easier to track it than ever before.

If you’re thinking, what is your wealth even worth? It’s worth a clearer understanding of your financial picture to support future financial decisions. And, with the sophisticated Prillionares platform, you’ve got a net worth calculator and an effortless money transfer app at your fingertips to make it easier.

Net worth isn’t limited to a business or individual – households can use a net worth calculator, schools and governments can, the list goes on. But, realistically, only a small amount of people actually track their wealth. Those that do can make more informed financial goals, build their wealth, and understand when cutbacks may be needed.

Not everyone will have a positive figure shown in their wealth calculator. Those with assets they don’t own, for example, a car on loan or a mortgage in its infancy and the house has lost value, often find their net worth is less than what they thought it would be – on the premise that if that asset is to go on sale, it would be the pay off debt rather than to gain wealth.

How To Calculate Net Worth?

It’s easy to start the calculation by first looking at your assets. By definition, an asset is anything with a value that you can sell and convert into cash. As you go through life, you’ll acquire multiple assets – but your income isn’t actually one of them despite that being the sum of money that keeps you going each day. But, if you’ve managed to save a lump sum of money from that income, that would then become an asset.

The main asset most adults have is property or land. Your home is likely to be the most valuable asset you have if you own it. But your home can also be a liability (explained in the next paragraph). Next is household furnishings like your TV, a car – if you own it – collectibles, jewelry – basically anything you have that’s yours that you can sell.

There are some financial assets that people sometimes forget about:

● Bonds

● Cash value of life insurance

● Mutual funds

● Retirement funds

● IRA, 401(k)

Businesses might look at machinery, tools, and company vehicles as assets.

Once you’ve totaled up your assets in the Prillionaires App, the net worth formula will ask for your liabilities. These, by definition, are financial obligations that deplete resources. Even though your home can be your biggest asset, it can also be your most substantial liability. Your mortgage is a loan. Therefore, it’s a liability. However, you’ll often find that selling your home covers the remaining loan amount and leaves you with a cash sum that could be an asset.

Other liabilities include:

● Credit cards

● Personal loans

● Car loans

● Accounts payable

Prillionaires software will ask you to detail all your assets and liabilities to calculate the total out for you using the formula.

Net Worth CALCULATOR – WEALTH CALCULATOR

The Prillionaires platform is a highly-advanced and user-friendly net worth tracker and calculator rolled into one. It’ll ask you to input all your assets and liabilities but not your income – net worth vs income is very different.

Using a wealth calculator like one on the Prillionairs software will allow you to make better future financial decisions, manage debts with ease, and grow investments. It reduces the risk of calculation errors – and by inputting and saving the data, the wealth calculator will store the details ready for future analysis or changes.